Apologies to readers much younger than me but given the age profile of our industry, I suspect a lot of you may recall the “Claytons” TV commercial.

Claytons was the non-alcoholic drink marketed in the 80s and the TV advert slogan was “the drink you have when you’re not having a drink”. Using the term Claytons became synonymous with occasions when one expected a significant event to occur but it was grossly underwhelming. We had two of those this week.

Interislander replacements

The government announced on Wednesday that it was setting up a Crown-owned company to buy two new ferries – and had appointed Minister Winston Peters to oversee it.

Frankly I found that pretty underwhelming and the reality is that it gives transport operators no greater confidence or certainty than before. We really expected much more progress to have been made, in terms of procurement of the vessels and detail on that portside infrastructure.

I am also surprised that it appears officials have spent 12 months landing a decision that will set up a government company to manage procurement. Over the next three months or so it will set up that company and complete procurement. It seems a little arse-about-face in terms of the periods of time and what decisions get made, but here’s hoping.

In the meantime what we’re doing is advocating to manage the risk we see over the next few months. Some advocates have suggested that without rail ro-ro ferries, rail freight in New Zealand will face an existential threat. Others have suggested that an iReX level of investment in rail ferries could result in considerable mode shift and massive efficiency gains. Respectfully, that rhetoric doesn’t match the reality.

Only one of the five current ferries is rail enabled. When that vessel is out of service, and it routinely is, life goes on. KiwiRail remains confident in its ability to move freight from North to South whether or not ferries are rail enabled. It is also worth noting that only a small proportion of rail freight actually moves between the two islands – five percent of total rail tonnage.

The Government’s Cook Strait priority should be ensuring an enduring, competitive freight and passenger connection. New Zealand cannot afford a return to a single operator with a service monopoly. This would inevitably drive-up prices for all freight customers and passengers, and leave us ill-equipped to handle the growing domestic freight task.

I don’t have a preconceived idea of what the service provider’s organisational structure should be, and I think it is unhelpful to let that be a major influence in decision making. That said, a private public partnership could reduce the pressure on the Government’s transport deficit, and harness some of innovation and dynamism that has seen Bluebridge become a major player in the face of a state-owned competitor. It is encouraging to see the Government add this option to the mix. When making a decision about ships and portside facilities, competition must be front of mind for the shareholding ministers.

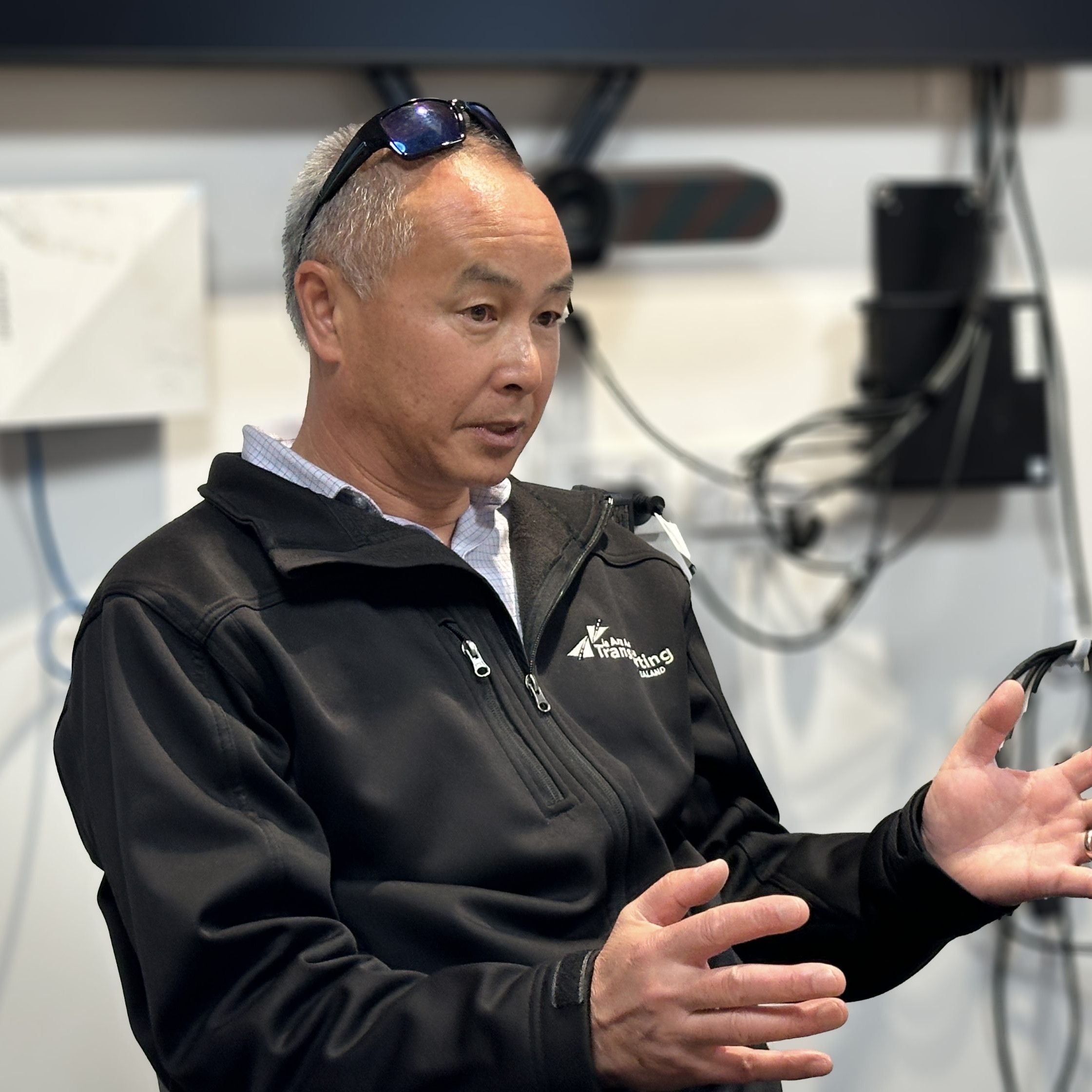

We have already lost a few years in the expected delivery of new vessels and cannot afford further delays. Transporting New Zealand is here to help the new Minister for Rail Winston Peters and his colleagues. Issues like rail ro-ro, climate and modal share shift are red herrings. Let’s put the rhetoric and red herrings to the side, and give all New Zealanders greater certainty and confidence in our supply chain from Cape Reinga to Bluff.

Emissions Reduction Plan 2 (ERP2)

On the same day the ferry announcement was made, the Government also released the second emissions reduction plan.

This plan outlines the key actions and initiatives to meet the second emission budget (2026 to 2030) and keep us on track to meet our 2050 net-zero target. The plan has targeted actions in the sectors of our economy that produce the greatest emissions – agriculture, transport, energy and waste. It also includes areas such as the New Zealand Emissions Trading Scheme and sustainable finance.

Transport (planes, trains, automobile and ships) were responsible for 17.5 percent of NZ’s gross greenhouse emissions in 2022. Heavy fleet contributed 28.2 percent of that.

The plan’s two key initiatives in the heavy vehicle space include:

- reviewing regulatory barriers to decarbonising heavy vehicles (e.g. EVs and hydrogen); and

- promoting innovation through the Low Emissions Heavy Vehicle Fund.

I find that pretty underwhelming.

The substantive progress in decarbonising the heavy fleet to date has been largely dependent on industry and market leadership. HWR Richardson, TR Group and Reliance Transport quickly spring to mind. I have no doubt innovation and leadership like this and other exemplars will continue and we applaud this and will continue to support.

However expectations of what our sector can achieve over the next period, particularly in this early adoption phase, need to be seen in the context of what government is prepared to commit. Frankly, at the moment, it’s not a lot.