Purpose

The purpose of this Advisory is to inform you that if your business has been affected by Cyclone Gabrielle or the Auckland flooding you may be eligible for financial support.

Operators needing support with businesses in the respective areas below should consider the information in the following links. Some of the funding applications are time bound, for example, in some cases funding assisting applications must be made before 31 March therefore we urge you to consider this information as soon as possible.

Areas and respective business support grant information

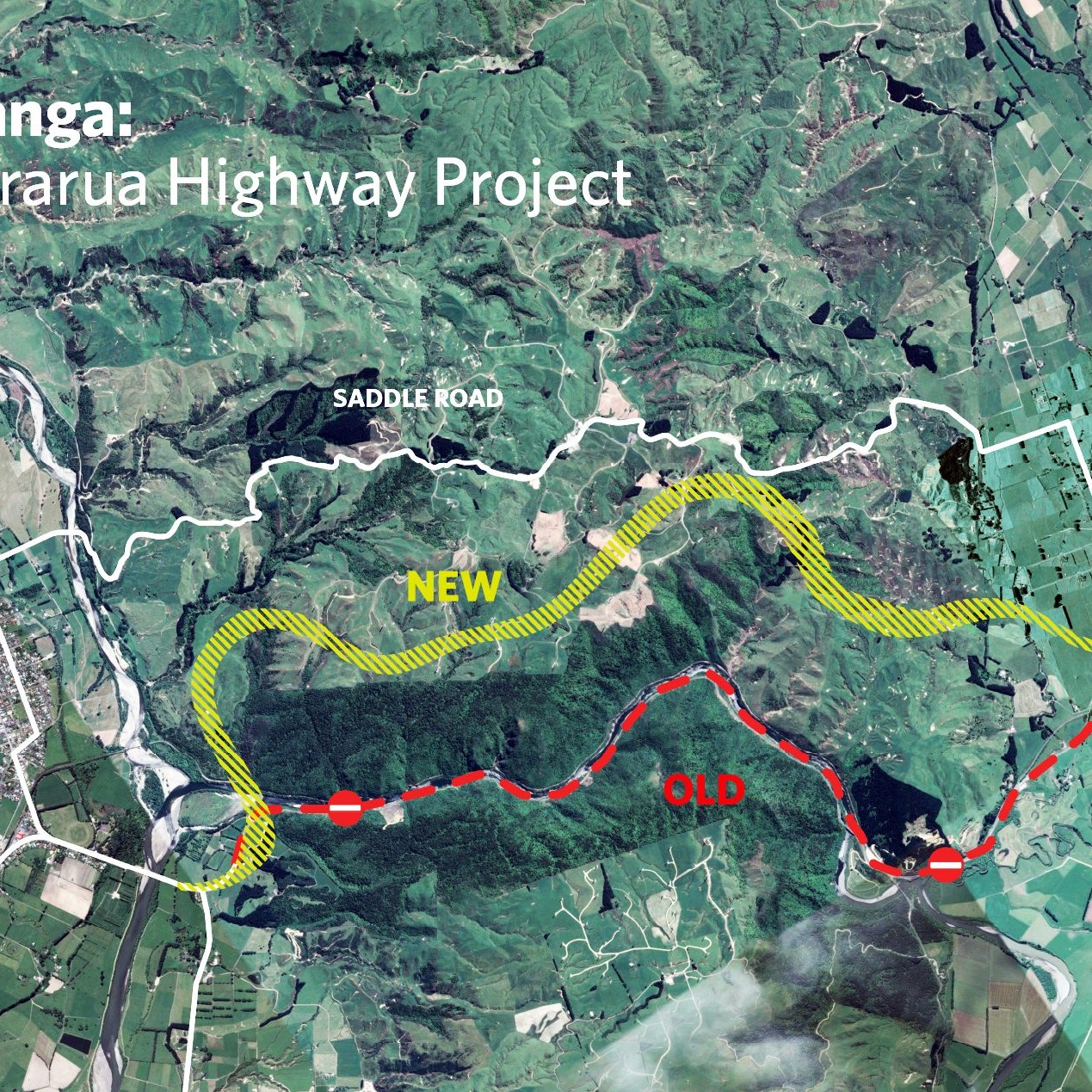

- Tararua

- Thames Coromandel

- Auckland

- Taitokerau Northland

- Tairawhiti

- Eastern Bay of Plenty

- Hawkes Bay

- Civil Defence Payment

- Westpac Small Business Flood

- Inland Revenue

- If you pay tax and have been affected by the extreme weather, Inland Revenue may be able to help. They may be able to remove late payment and filing penalties, and write off tax, penalties and interest if collecting it would put you in serious hardship.

- If you’ve lost some or all your tax records in the flooding, Inland Revenue can work around this also.

- IR has set up a dedicated line to take your calls 0800 473 566, and are also monitoring messages sent through their myIR system. When you’re sending a message through that secure e-mail,you can use the word ‘flood’ to help prioritise those messages