Auckland Mayor Wayne Brown’s announcement that, in essence, Auckland’s port land, assets, and operations will be retained under council ownership and the Port of Auckland has agreed to deliver much improved profits to Auckland Council, is interesting and timely.

The certainty this announcement brings certainly has benefits.

A big question though is how the improved profits are to be raised. One of the risks we see is that additional charges will be placed on goods passing through the Port without those increases actually adding any value, other than showing up as “improved profit”.

In my view money can be spent in three ways in this situation.

One is on compliance and meeting regulatory requirements.

The other is investing it to achieve better overall outcomes such as improving productivity which ultimately leads to win-win outcomes. Roads that create greater certainty and reliability on travel times, systems that reduce congestion and downtime for trucks awaiting drop off or pick up, or greater coordination of supply chain like the recently developed Fairfield Freight Hub are great examples of the latter.

However, money can also be transferred or redistributed without adding value to the system. For example, there are scenarios where charges can be increased while providing little, if any, value-add. Whilst there’s a view that market forces will drive pricing, I’d argue the approach of making money out of charges becomes easier when there’s a relatively captive market. Airport car parking is one example that comes to my mind.

Ports are another area this could occur.

We’ve heard the arguments that the Port charges for containers are low compared to overseas. To us, referencing those rates is pretty meaningless unless spoken of in context of the port’s productivity and efficiency rates.

If the Ports simply increase container prices without improving productivity, then certainly that extra income could show up as win for Auckland City ratepayers. But in reality those increased charges will need to be collected and paid for by others in the supply chain. It reminds me of the old adage, Robbing Peter to pay Paul.

Time will tell what happens but we’ll be watching what happens at POAL with interest.

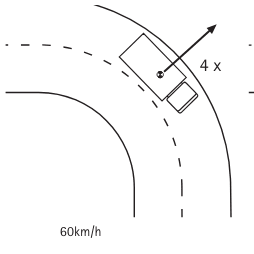

On other money matters, last December we provided a submission to Tauranga City Council (TCC) during its consultation on the Long-term Plan 2024-2034 (LTP). Our main focus was on its thoughts about exploring SmartTrip variable road pricing to help reduce congestion and fund transport improvements.

We advocated that pricing mechanisms can be beneficial to reducing congestion and carbon emissions providing they are applied correctly and align with the fundamentals of good practice.

TCC has chosen not to proceed with SmartTrip variable road pricing at this stage.

The council’s been approached by NZTA Waka Kotahi and together with other local authorities, such as Auckland Council, it has been invited to work on a nationally consistent approach to road pricing.

It’s decided to include a budget of $500,000 for each of the first three years of the LTP to investigate ways of addressing community concerns on road pricing raised during consultation and participate in a national approach to road pricing legislation.

Sounds to me like major changes to road pricing and revenue generation are some time away, and ultimately that will show up as further delays investing in roading.