Transporting New Zealand, the main national association representing road transport operators, is welcoming the Budget announcement of substantial funding increases for roading and infrastructure projects. But it warns that many operators are facing tough times – and the rising cost of living is having a major impact on businesses.

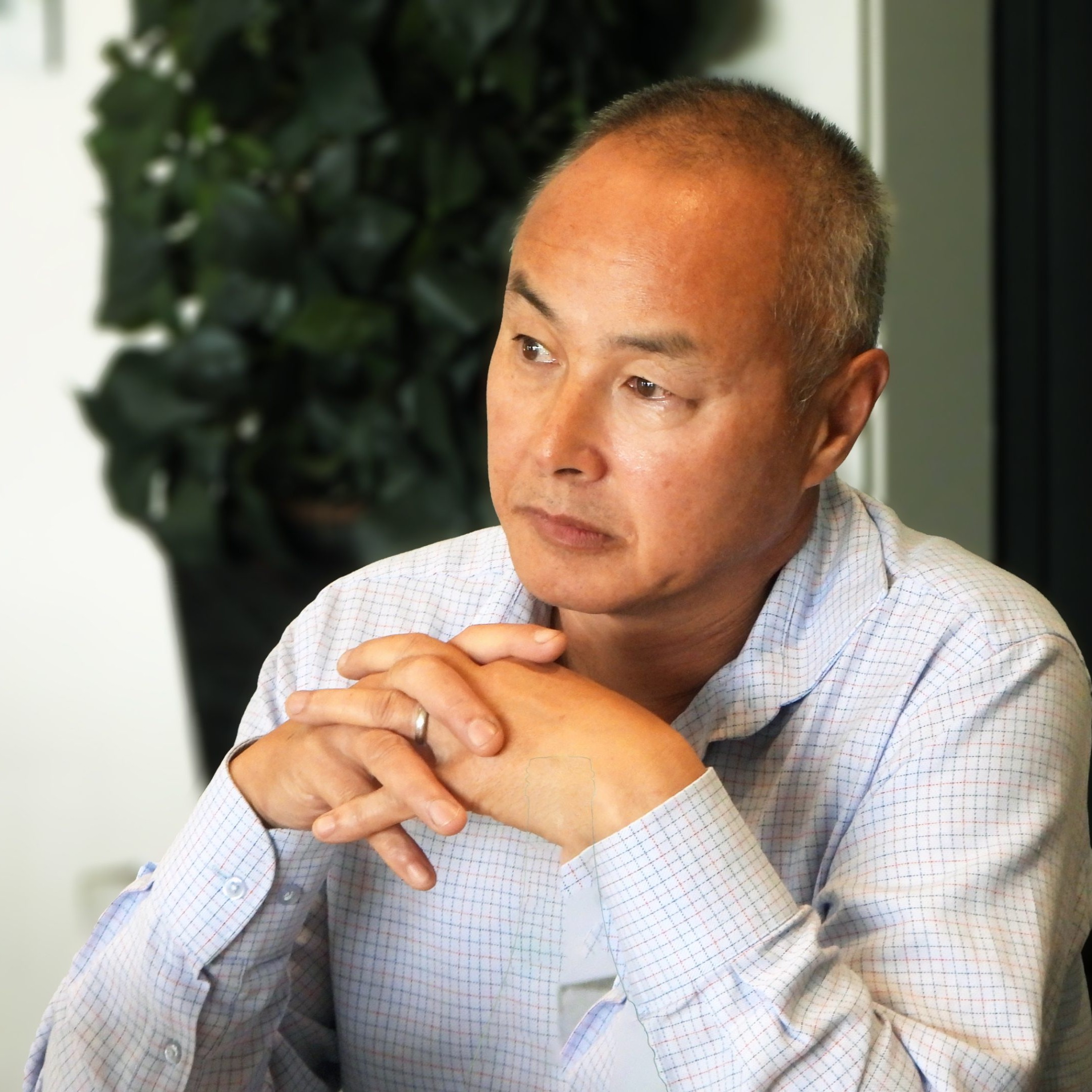

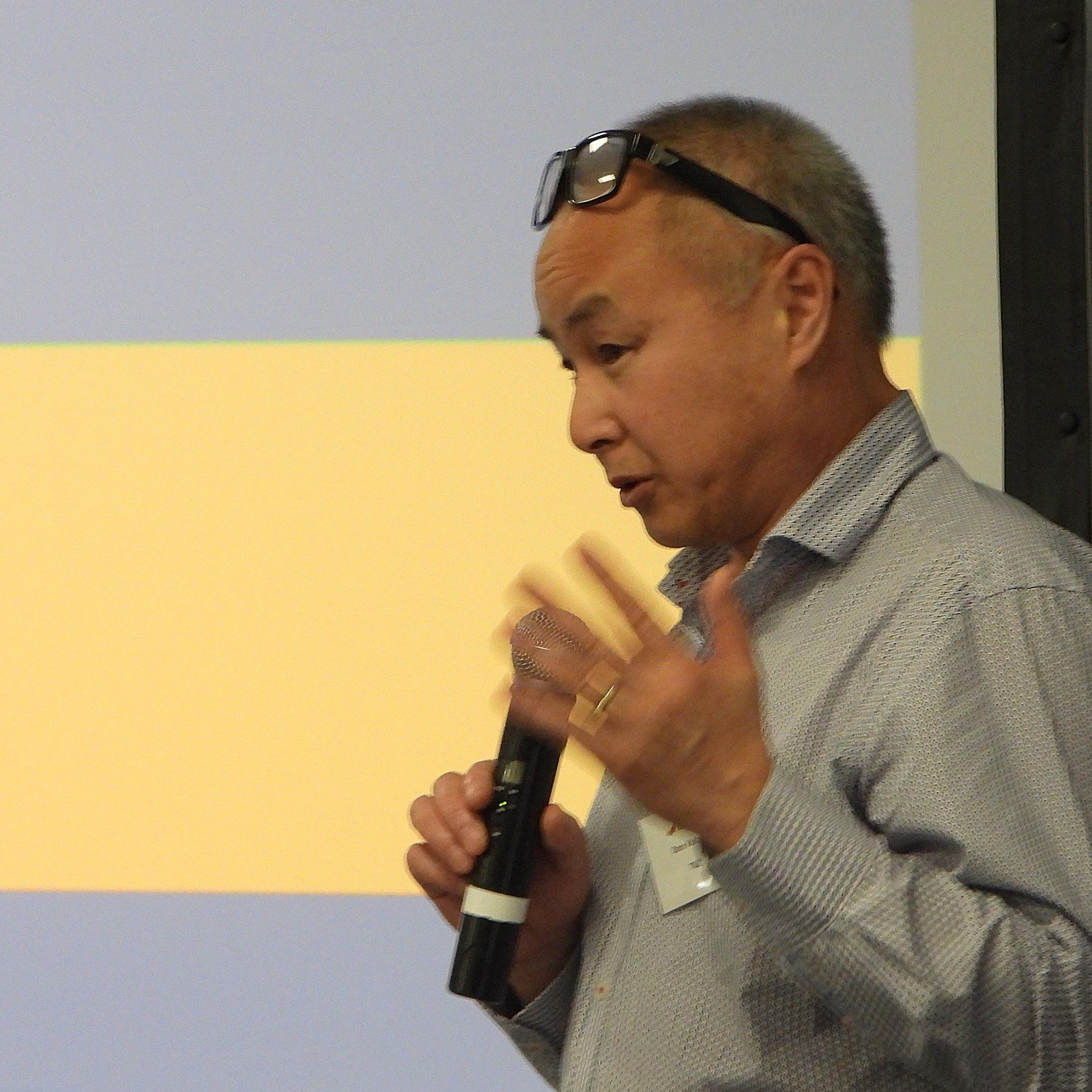

“Roads in New Zealand have been desperately underfunded for decades so new investment in highways, including national and regional roads of significance, is desperately needed,” says interim chief executive, Dom Kalasih. “Kiwis can’t continue to put up with deteriorating roads that are jeopardising economic growth, which is vital for the community and businesses.”

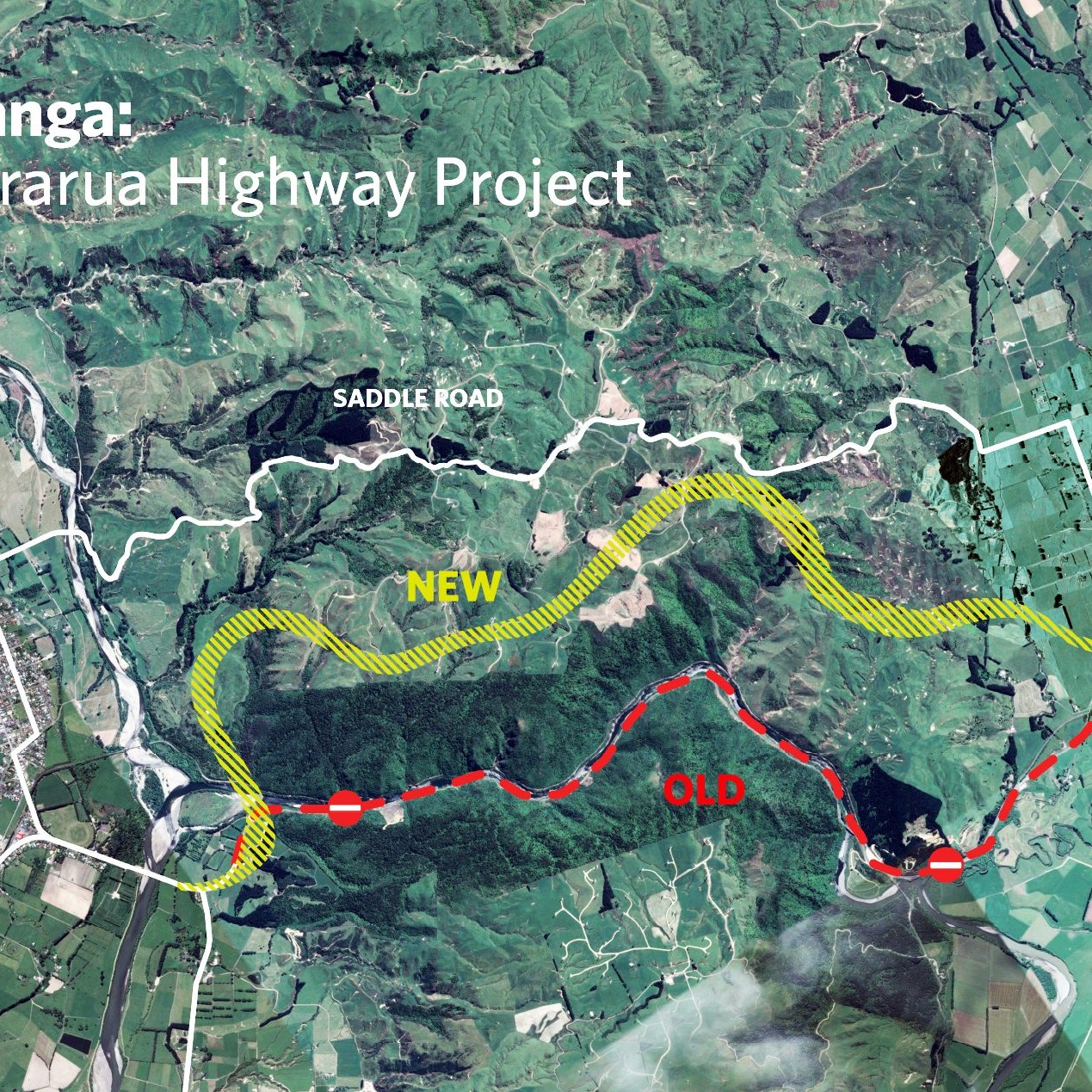

Kalasih says investments in transport and tax relief will be welcome news to Transporting New Zealand’s members. The Budget announced the government will spend $1 billion to accelerate land transport projects including Roads of National Significance.

This is on top of $20.7 billion already signalled in the Government Policy Statement on land transport. Other transport investments include $939 million to repair roads damaged by last year’s severe weather events in the North Island, and $200 million for maintenance and renewals on the national rail network.

Another $1.2 billion will go to the new Regional Infrastructure Fund, and the government will also establish a National Infrastructure Agency.

Kalasih says that road transport operators are reporting low demand and increasingly tough economic conditions.

“Transporting New Zealand is hearing from many members who have seen revenue drop significantly over the past few months. Many trucking firms haven’t seen the traditional post-Christmas uptick in business, with bulk and aggregate and logging operators some of the worst affected.”

Transporting New Zealand account manager, Lindsay Calvi-Freeman, has been checking in with members across the lower North Island, and says he’s getting a mixed picture during his calls.

“I’ve spoken to members with their revenue down 40 per cent on last year, and others who have been forced to lay off staff, the last thing anyone wants to be doing. Fortunately, there are a reasonable number of operators reporting reasonably steady demand, but almost everyone has noticed an impact.”

Fellow account manager, Odette Geyer, says the pain is being felt across the supply chain.

“We’re seeing an increasing number of liquidations, as the cost of lending and reduced business confidence starts to bite. Last week we saw three transport liquidations announced in three days. The road freight industry also supports a whole range of suppliers, and so tough conditions for our members have a big flow-on effect.”

Vicki Harris, who manages Transporting New Zealand’s member benefits and commercial partners, says she has noticed an increase in members looking for savings across fuel, insurance and supplier services.

“It’s really tough out there at the moment. A lot of members are looking to cut expenditure and maximise their bang for buck. We’re seeing a good number of referrals through to Transporting New Zealand’s supplier discount schemes, including fuel and tyre retailers.”

Economic indicators

The tough operating conditions reported by trucking operators is supported by the latest economic data. The Reserve Bank noted in its May 2024 Monetary Policy Statement that economic indicators have been weak, as growth remains subdued. The Reserve Bank isn’t forecasting an Official Cash Rate cut and associated interest rate relief until mid-2025.

The April 2024 ANZ New Zealand Business Outlook survey reported business confidence fell across every sector from March to April 2024. The March 2024 NZIER Quarterly Survey of Business Opinion showed net 23 per cent of firms reported a decline in activity over the March quarter. This is in line with the feedback Transporting New Zealand is receiving from members.

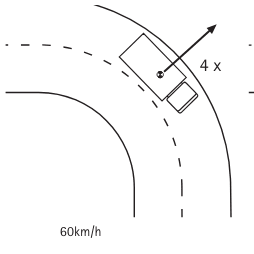

There was some more welcome news in the May 2024 ANZ Truckometer, showing the heavy traffic index up 3.3 per cent higher than 12 months ago (using a three-month average), and rising 0.3 per cent month-to-month. The heavy traffic index tracks the flows of vehicles weighing more than 3.5 tonnes on 11 key roads, and has a strong contemporaneous relationship to GDP. However, the Truckometer doesn’t reflect factors like reduced loads, or vehicle movements outside of those identified routes, that will both be impacting Transporting New Zealand’s membership and the wider road freight industry.

Road freight sector remains resilient

Dom Kalasih says he’s confident the road freight industry will navigate the difficult economic conditions, as they have with previous challenges.

“Over the past few years, we’ve seen road freight operators successfully deal with the COVID pandemic and severe pressures on the supply chain, acute driver shortages and cost pressures, and now the dual challenges of an economic recession and continued inflationary pressure. Things are tough, but road freight firms are very resilient.”